The dictionary definition of inflation:

Economics: a general increase in prices and fall in the purchasing value of money: policies aimed at controlling inflation; [as modifier] : high inflation rates.

Over the last several months of researching the economic data for a 1st Tuesday subject to post, we noticed inflation indicators pointing to it coming- and soon. The last time the US dealt with serious inflation, a lot of you weren’t born yet. Inflation hurts all participants in the economy in some way. An awareness of what inflation is about will help you adjust your behavior to successfully weather it.

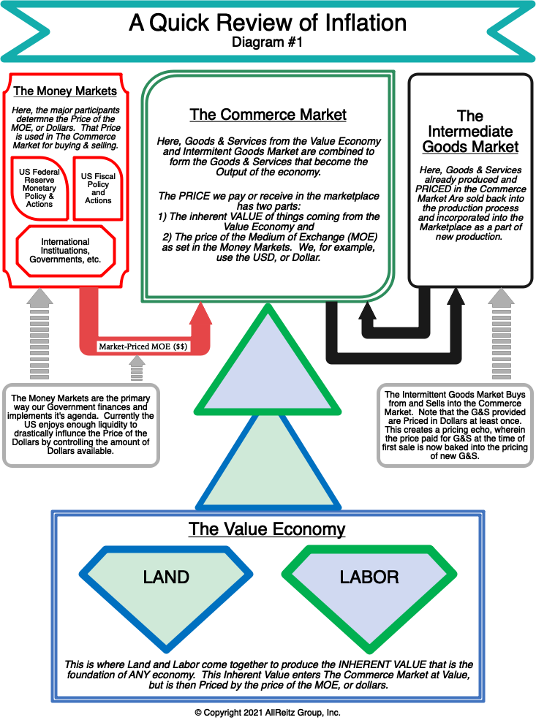

(It will make this simpler if you please review Diagram #1.)

At the bottom of Diagram #1 is theValue Economy, where Land and Labor combine to create Inherent Value (IValue). Think of it as bartering. Participants know what, say, an hour of their time is worth in food. That agreement sets the IValue for those two resources relative to each other. When that IValue gets into the Commerce Market (the part of the economy we shop in), it is priced in, for us, dollars. The value, as a price, of those dollars, is determined by supply & demand in the Money Markets.

The Money Markets are the world’s largest ( by $ volume) and most active exchanges. Here, all players represent a different interest (a government, a bank, a brokerage house, etc.). Through buying and selling financial instruments, each player seeks their target price for their target instrument. An easy example is the US Federal Reserve participating to seek a target price for the US dollar, broadly known as Monetary policy. The Fed also funds the needs of the US government or Fiscal Policy. As the government spends more, the Fed needs to ‘accommodate’ the part of that spending that exceeds government revenue, or the deficit.

With the table set, here is an elementary look at inflation.

Think of inflation as the ‘fall in the purchasing value of money’ part of the above definition, or the street definition, “Too many dollars chasing too few goods”. The IValue the Value Economy produces stays the same, but ‘accommodative’ Monetary Policy puts more dollars on the market. Buyers price the dollar lower because of the oversupply. That lower price goes to the Commerce Market to price goods and services. However, now it takes more dollars to buy the IValue, even though the IValue never changed. The prices we pay for our goods & services goes up because of ‘too many dollars’ chasing the same value, our IValue.

So What?

Inflation’s danger is that once it’s here, it takes time and hard choices to stop. Until then, it is a self-feeding beast, as higher prices in the Intermediate Goods Market feedback into the Commerce Market. Interest Rates, so mortgage rates, go up, business loan rates rise and are harder to qualify for, asset prices rise (houses) making it harder to afford what you need. Finally, wages go up to meet the drop in the value of the dollar. So, prices must go up to cover the increased production costs. The indications are that inflation is already here, with the Money Markets ready to make it a reality. Be aware.

No comments! Be the first commenter?